Poland plans 3% tax on tech giants

Digital minister, Krzysztof Gawkowski, wants to target large tech companies’ revenues, including turnover generated by platforms monetising personalised advertising or selling user data

Poland is planning to levy a 3% tax on large tech companies which it wants to support its own technology and media sectors.

As negotiations to adapt the global tax system to modern digital realities continue at the OECD level, many European countries are working on their own taxes targeting large, predominantly US tech companies.

These efforts have caught the attention and ire of US President Donald Trump. But despite noisy pushback from his administration – including threats of retaliation via trade tariffs – a number of countries are pressing on.

In Poland, Donald Tusk’s government signalled its intent to tax Big Tech back in March. Further details of the plan are now starting to emerge.

Work on Poland’s draft bill will “continue through the end of the year”, the digital ministry told Euractiv. Once ready, it said the bill will undergo public consultation. Depending on the legislative process, the tax could take effect as soon as 2027.

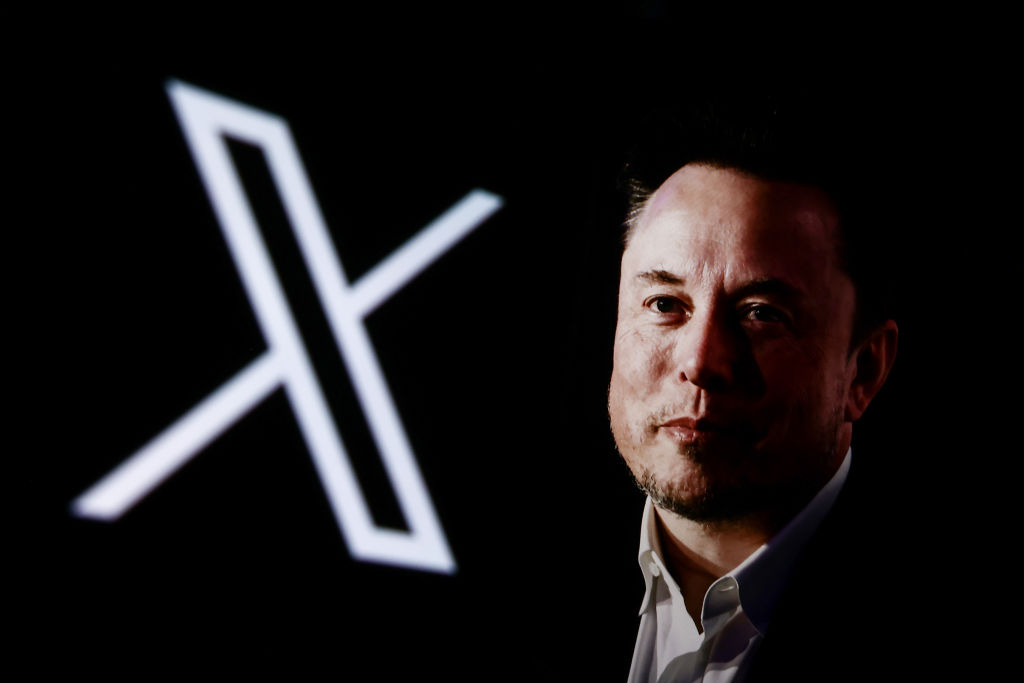

The ministry said the tax will apply to companies whose global revenue exceeds €750 million. It will be aimed at platforms including marketplaces, social media and ride-sharing apps, as well as companies carrying personalised advertisements or selling user data.

Services that only provide users with access to content (such as games) or interfaces (such as payment or comms platforms) are set to be exempt, as are financial services and direct web sales – such as via a retail company’s own website.

Companies would have to report revenues generated in Poland or in relation to Poland, based on whether they can “reasonably assume” users are residents of the country – for example through their IP addresses, per the ministry.

It added that a “modest” 3% tax on tech giants’ revenues could generate up to €470 million in the first year. The ministry expects the tax take to continue to grow after that.

The proposal appears quite similar to the Commission’s draft for an EU-wide digital tax from 2018 – which would have paid into national treasuries – but got abandoned after member states were unable to reach agreement.

The Commission also publicly mulled introducing an EU digital tax to pay back the Union’s Covid recovery debts. However, instead, it recently proposed an EU-wide tax on large companies in general.

(nl)